Are you upset because your auto insurance costs keep going up? Last year, many drivers saw their premiums rise by 15 percent or more. This post will explain why prices are higher and how you can push back using our expert insurance tips.

Table of Contents

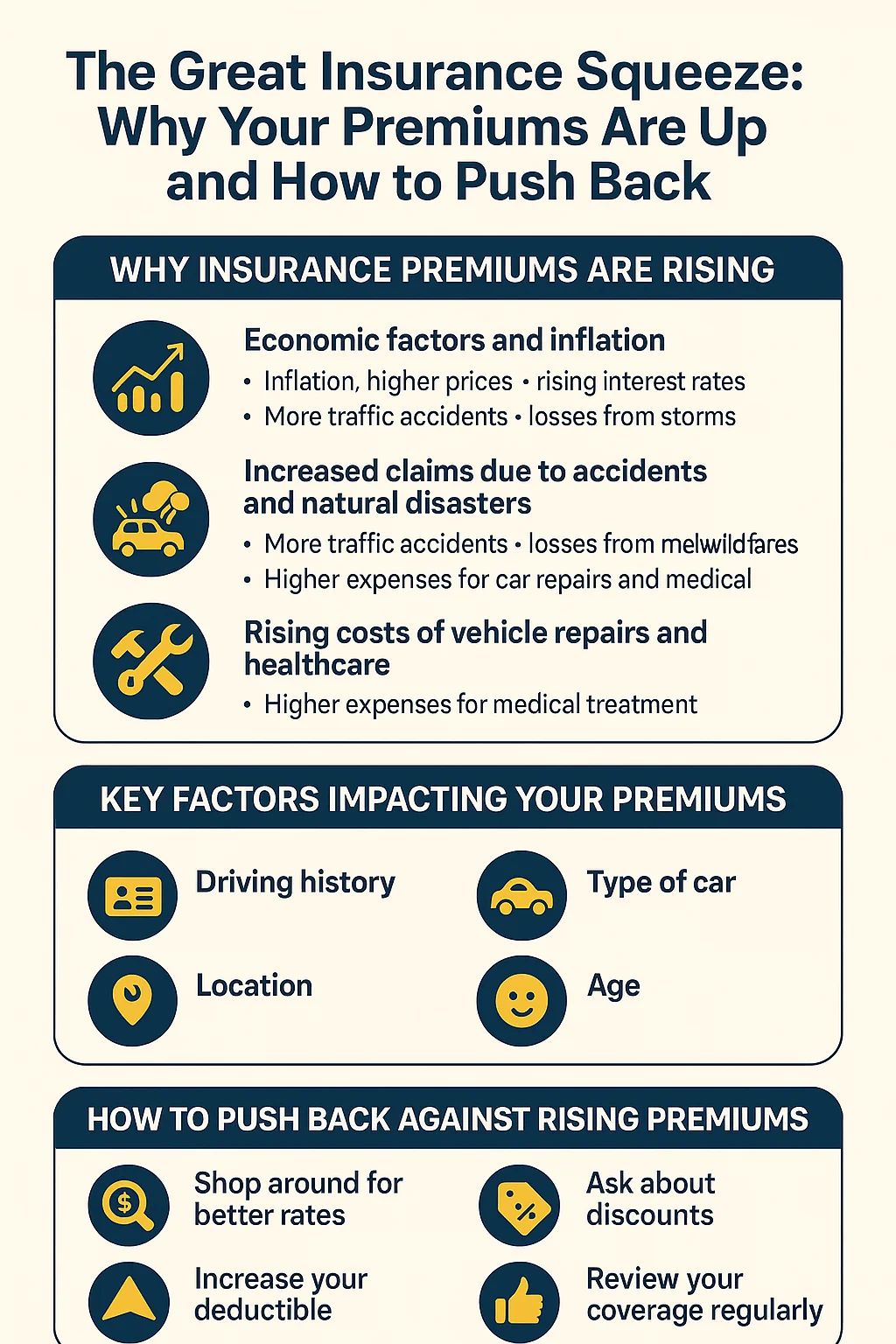

ToggleWhy Insurance Premiums Are Rising

Insurance premiums are rising for several reasons. The economy is facing inflation, which means goods and services cost more. There are more claims due to accidents and natural disasters.

Vehicle repairs and healthcare expenses have also gone up, pushing premiums higher.

Economic factors and inflation

Higher prices for goods and services affect your insurance premiums. Inflation hit 8 percent in the United States during 2022, making everything from car parts to labor more expensive.

Companies pass these costs on to customers, so premiums go up too.

Prices are rising everywhere, so we have no choice but to adjust, said a spokesperson from Allstate in early 2023.

Rising interest rates also make it harder for insurers to balance their budgets. As a result, policyholders feel the squeeze even if they do not file claims. Next, see how more accidents and natural disasters drive these increases further.

Increased claims due to accidents and natural disasters

Car accidents and natural disasters have caused more people to file insurance claims. Reports from 2023 showed that major storms like Hurricane Ian in Florida led to billions of dollars in losses for insurance companies.

More wildfires, floods, and hailstorms also damaged homes and cars across the United States. This increase in claims means insurers have to pay out more money.

As a result, they raise premiums for everyone to cover these costs. Traffic accidents also rose by about 10 percent last year, according to the National Highway Traffic Safety Administration.

More crashes mean more vehicle repairs and medical costs, which push rates up even higher. Insurance providers spread these rising expenses among all policyholders through higher monthly bills.

Rising costs of vehicle repairs and healthcare

Natural disasters and more accidents mean insurance companies must pay out more claims. These higher payouts add pressure to the system.

The price of fixing cars has jumped, too. Modern vehicles have complex electronics and smart sensors. Repairing a bumper or headlight now costs much more than it did even five years ago.

Healthcare expenses related to accident injuries have also soared in recent years. Hospitals charge more for treatments, tests, and doctor visits. As repair bills and medical costs go up, insurance premiums rise to cover these growing expenses.

Key Factors Impacting Your Premiums

Your driving history affects your insurance premiums. Safe drivers usually pay less. Drivers with accidents or tickets can see higher rates. Insurance companies look at how often you claim before setting prices.

If you have a lot of claims, expect to pay more.

The type of car you drive also matters. Some vehicles cost more to insure than others. Sports cars and luxury models often mean higher premiums. Your location plays a big role too; places with high crime rates or many accidents tend to have higher costs.

Finally, your age and credit score can impact your rates as well; younger drivers may face steeper costs due to inexperience, while good credit often leads to lower premiums.

How to Push Back Against Rising Premiums

Costs may feel overwhelming, but you can take action. There are clear steps to help reduce your insurance premiums.

- Shop around for better rates. The single most effective way to combat rising premiums is to compare quotes from multiple carriers. Market conditions vary, and a company that was competitive last year might not be today. Using an independent resource to compare offers is crucial. For a broad overview of the market, a Rodney D Young Insurance comparison form can provide quotes from a wide network of providers, helping you see all your options in one place.

- Increase your deductible. A higher deductible means lower monthly payments. Make sure you can afford the out-of-pocket cost in case of an accident.

- Bundle your policies. Many insurers give discounts if you combine home and auto insurance. This can cut costs significantly.

- Ask about discounts. Many insurers offer savings for safe driving or low mileage. Check what discounts apply to you.

- Maintain a good credit score. A higher score often leads to lower premiums. Pay bills on time and keep debt levels low.

- Review your coverage regularly. Needs change over time, so adjust your coverage as necessary. Remove any extras that no longer fit your situation.

- Take advantage of safety features in your vehicle or home. Items like alarms or anti-lock brakes can lead to discounts with some insurers.

- Consider usage-based insurance plans if available in your area. These plans track how much and how safely you drive, potentially lowering costs based on good habits.

- Stay informed about state regulations regarding insurance rates and coverage options; they can vary greatly from place to place.

- Seek advice from an independent agent. For personalized tips based on your specific situation, consulting a comparison service can suggest effective ways to save. For instance, those specifically looking for auto coverage can explore options through Young America Auto Insurance, which specializes in helping drivers compare rates to find the most affordable policy for their profile.

Conclusion

Insurance costs are rising, but you can take action. Shop around for better rates. Ask about discounts that fit your needs. Stay informed about changes that affect you. Don’t let high premiums hold you back; push back and save money!